2025 Standard Deduction Married Filing Joint

2025 Standard Deduction Married Filing Joint - Standard Deduction 2025 Married Filing Jointly Sammy Coraline, Married filing jointly is a tax filing status that lets married couples report combined income, credits and deductions on one tax return. Bloomberg tax & accounting released its 2025 projected u.s. Kansas governor laura kelly signed into law s.

Standard Deduction 2025 Married Filing Jointly Sammy Coraline, Married filing jointly is a tax filing status that lets married couples report combined income, credits and deductions on one tax return.

2025 Standard Deduction Married Filing Joint. When you turn 65, you become eligible for an additional standard deduction on top of the regular standard deduction. If you are at least 65 or blind, you can claim an additional 2025 standard deduction of $1,950 (also $1,950 if using the single or head of household filing status).

Married File Joint Standard Deduction 2025 Renae SaraAnn, The deduction on family pension for pensioners is proposed to be enhanced from ₹15,000 to ₹25,000

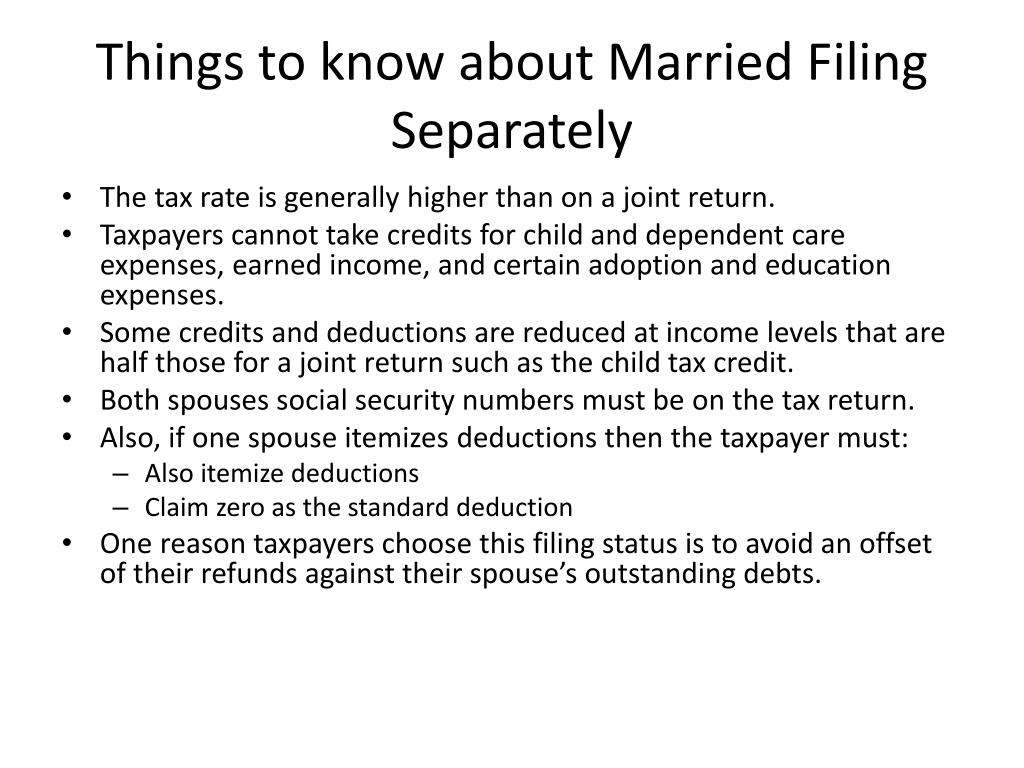

2025 Standard Tax Deduction Married Jointly Married Filing Lanni Modesta, Rate married filing jointly single individual head of household married filing separately;

Married File Joint Standard Deduction 2025 Myrah Tiphany, Use this free online income tax calculator to estimate your federal tax refund or.

2025 Standard Deduction Married Filing Joint Jean Corrianne, 25 jul 2025, 07:51:10 am ist income tax budget 2025 live:

2025 Standard Deduction Married Joint Loni Sibley, However, the amount of this extra deduction.

Married Filing Jointly Tax Brackets 2025 Standard Deduction Kelli, Section 63(c)(2) of the code provides the standard deduction for use in filing individual income tax returns.

Standard Business Deduction 2025 Married Joya Rubina, For the 2025 tax year, dependents can.

2022 Tax Tables Married Filing Jointly Printable Form, Templates and, If you're both 65 and.

What Is The Standard Deduction For 2025 Joint Joane Odelia, 66% taxpayers opted for new regime for itr filing during current season, says cbdt chairman

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)